10

Years of experience in Fintech services

4667410

Loans taken

1855823

Clients

Get to Know About

We provide solutions

to your day-to-day problems.

Loans of up to 10 000 FCFA

Momokash is a nano-credit digital solution that provides access to small loans of up to 10,000 FCFA with competitive interest rates. This small loan amount is designed to meet immediate financial needs or address short-term cash flow gaps.

Momokash aims to provide fast and efficient loan approvals. Once the loan application is submitted through the short code *126# option 6, borrowers can expect a prompt decision, allowing for timely access to funds.

Loans of up to 1,000,000 FCFA

Corpocash is a loan digital USSD solution that enables users to access loans of up to 1,000,000 FCFA.

Corpocash utilizes USSD technology, allowing users to access the loan application and management system by dialing *126# option 6, on their mobile phones. This ensures that users can apply for loans and manage their accounts without the need for internet connectivity or a smartphone.

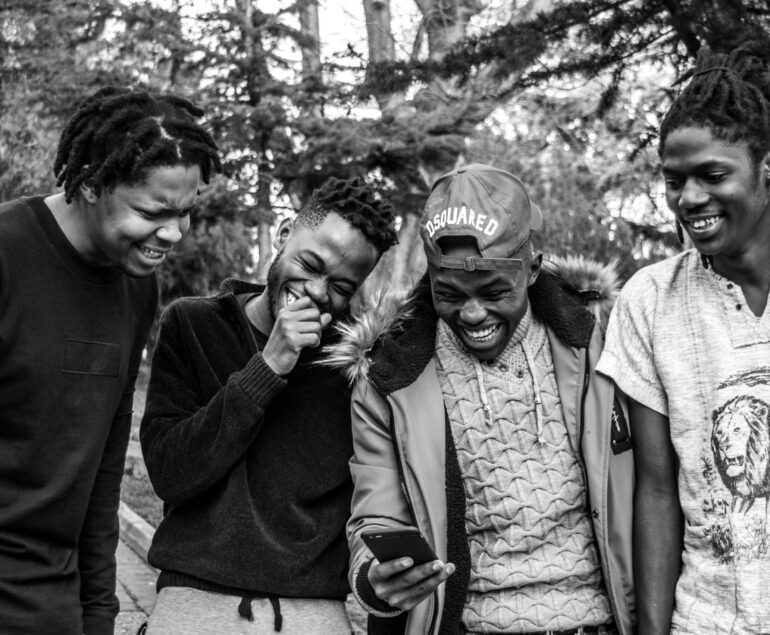

Customers Testimonials

What clients say about us.

Thanks to MoMoKash, I was able to repair my car and continue commuting to work without stress. It truly changed my daily life. A big thank you for this accessible and human solution.

I needed a little boost to start my online selling project. MoMoKash allowed me to finance my first inventory without going through lengthy and complicated processes. Thank you!

I was pleasantly surprised by how quickly I could get a nano-loan. In just a few clicks, the funds were transferred to my MoMo account instantaneously. It’s the perfect solution for financial emergencies!

CCC

RAINBOW

MTN

NOFIA

CAMCCUL

RENAPROV